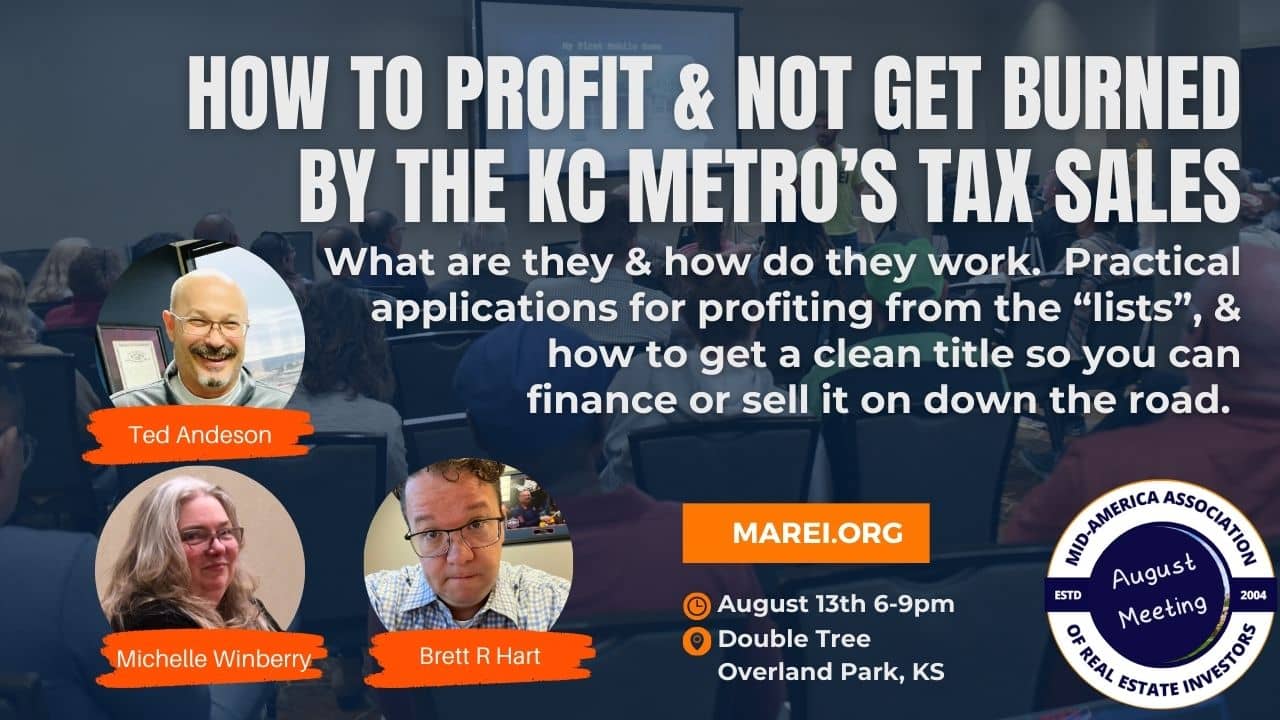

It's Tax Sale Season in Kansas City - Are You Ready?

Investing in Tax Liens and Deeds is not for the faint of heart. Despite the flashy ads claiming they are the "Best Kept Secret of America's Wealthy," jumping in without proper knowledge can cost you dearly.

To help you navigate the complexities and seize the right opportunities, we’ve gathered a panel of experts to answer your pressing questions about tax sales:

- How do tax liens and deeds work?

- What steps must you take to bid on a certificate or deed?

- Are you buying a lien, a certificate, or the property itself? What's the difference?

- Who handles the foreclosure process—the county, you, or both?

- When do you gain possession? Immediately, a month later, a year later, or even two years?

- What returns can you expect if the taxpayer eventually pays?

- What should you look for when buying a property from the tax sale process?

- Can you obtain title insurance, and what does it cover or exclude?

- How do other investors profit from buying liens and deeds?

- What are other strategies to secure deals before and after the sale directly from the taxpayer homeowner?

Meet Our Expert Panel:

- Ted Anderson: A local attorney specializing in delinquent land tax sales, Ted brings extensive knowledge and expertise to the table.

- Michelle Winberry: A seasoned real estate investor, Michelle has navigated numerous complex transactions, turning potential problems into profitable opportunities.

- Brett R Hart: A local title expert who can take on many of those closings with Tax Sale Hair on them that others might not.

We also expect that we will have quite a bit of help from the friends and families of our experts who might add their 2 cents.

Don't miss this opportunity to gain invaluable insights and network with fellow investors. Click the register button below to reserve your seat. The meeting is free for MAREI members and first-time guests. Repeat guests can attend for a $35 fee, or join MAREI for just $25 a month and enjoy all the benefits of membership.

Agenda

5:00 Set up Time

6:00 Vendor Expo

6:00 Networking Time

6:30 New Member / Guest Meet & Greet

7:00 Guest Host with Monthly Announcements

7:20 Guest Speakers

8:50 Networking & After Hours

Members:

Free For Members

Send a Free Guest Pass!

Know someone who is interested in this event? Invite your friends by sending a Free Guest Pass to them!

Send a Guest Pass!