Did you miss the meeting - it was packed with great info. Beginning Investors, Wholesalers, Flippers and Even Buy and Hold Investors will come away with new ideas they need to consider.

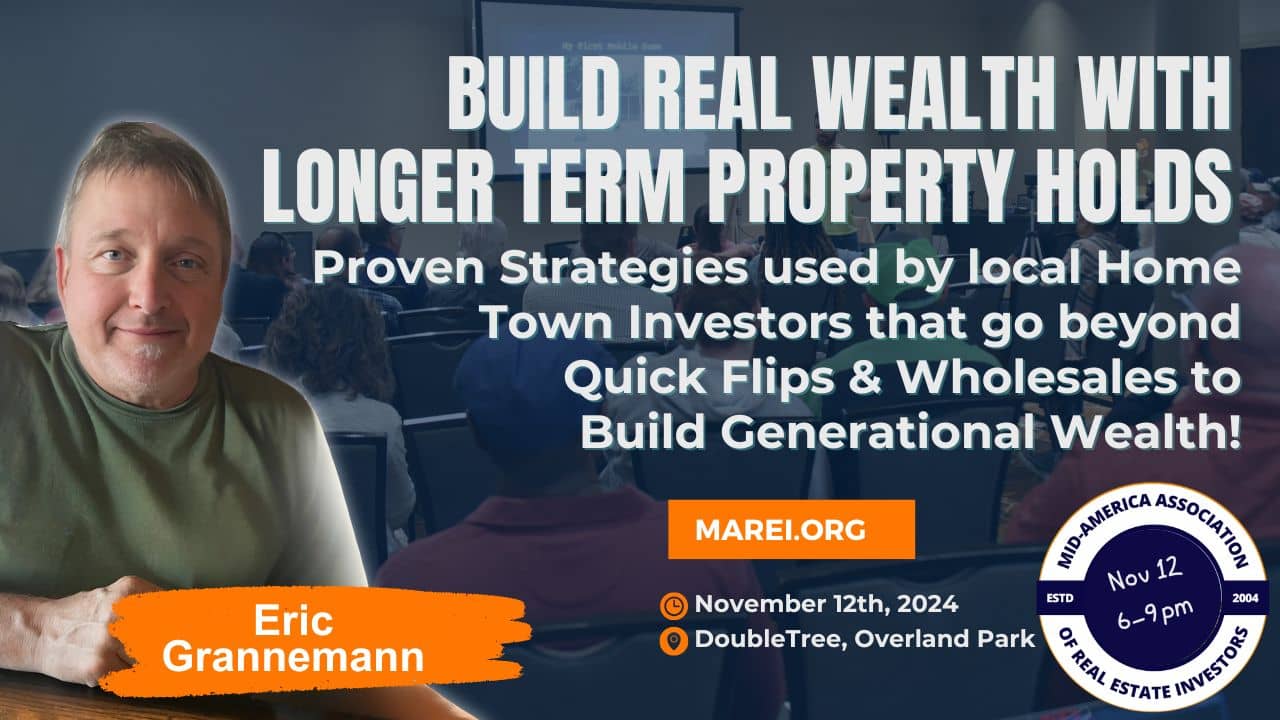

🔥 How to Build Real Wealth Through Real Estate (WITHOUT Chasing Unicorn Flips or Risky Deals!)

📅 Date & Time: Tuesday, November 12th, 6:00 PM - 9:00 PM

📍 Location: Double Tree in Overland Park

ATTENTION REAL ESTATE INVESTORS

Are you tired of grinding out deals, chasing the next big thing, only to end up with nothing to show for it? Flipping might sound sexy, but if you’re relying on the “quick buck” strategy, you’re leaving HUGE wealth on the table.

Here’s the truth: The real money in real estate is built over time. Generational wealth. And the strategy? Longer-term property holds that build wealth month after month, year after year!

I’m talking about cash flow, appreciation, equity paydown, and massive tax benefits you can leverage RIGHT NOW to create real wealth that grows with you.

That’s exactly what Eric Grannemann is going to teach you at our upcoming MAREI meeting. Eric is a local, seasoned investor who’s built his wealth the right way—and he’s about to reveal how you can do the same.

Here’s what you’ll discover at this exclusive event:

- Eric's Strategy to increase property value with repairs and upgrades

- How to profit with cash flow from rentals (money that works for you!)

- The secret to wealth-building through appreciation and equity paydown

- How to take advantage of depreciation and 1031 exchanges & other tax advantages to keep more of what you make

- And how to move to bigger and better properties

Eric’s going to show you how simple it is to start creating long-term, sustainable wealth in real estate. This isn’t theory—it’s proven, battle-tested strategies that are working right now in Kansas City.

Admission: Free for MAREI members and first-time guests. Non-members: $35, or you can join MAREI and unlock a ton of ongoing benefits. (Your future self will thank you!)

👉 Click the button at the bottom right NOW to register before you miss out!

Event Agenda:

- 6:00 pm – Vendor #MAREITradeShow & Networking

- 7:00 pm – Market Update with Kyle Niemann

- 7:25 pm – Eric Grannemann Presentation

This meeting is recorded and made available to MAREI members on our replay page.

After building your wealth with Eric on Tuesday, learn how to keep it with Attorney Lee Phillips's Master Class on Saturday on Generational Wealth through the Right Estate Planning.

Members:

Free For Members

Send a Free Guest Pass!

Know someone who is interested in this event? Invite your friends by sending a Free Guest Pass to them!

Send a Guest Pass!